Section 125, enacted by the IRS in 1978, allows employees to allocate portions of salary towards certain healthcare benefits on a pre-tax basis.

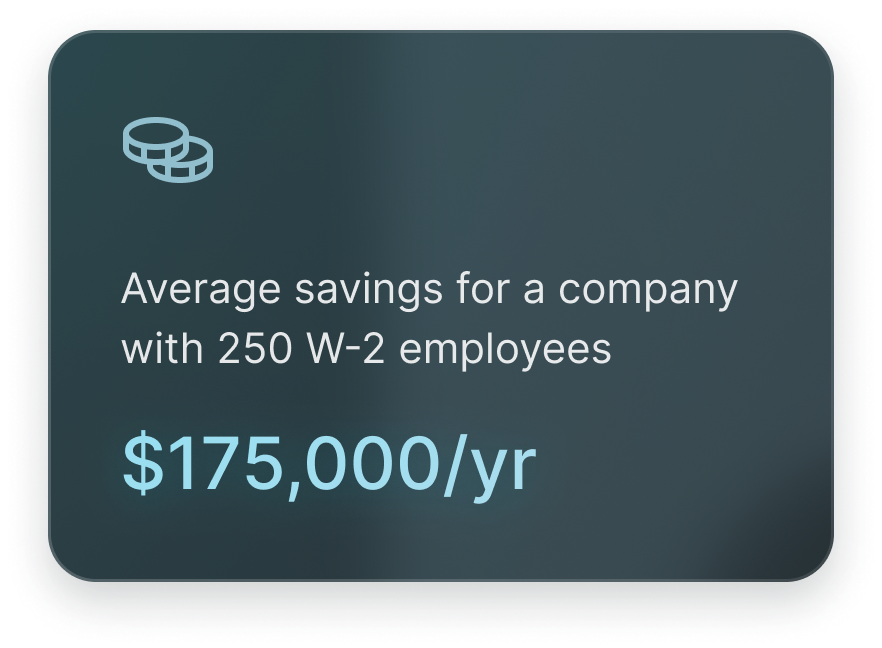

Employers can utilize Section 125 to offer their W-2 employees pre-tax health benefits, reducing taxable income, and saving the company on FICA taxes.

Flex Health empowers employers through a fully funded Section 125 Plan, with no out-of-pocket cost and a net paycheck increase for all qualified employees.

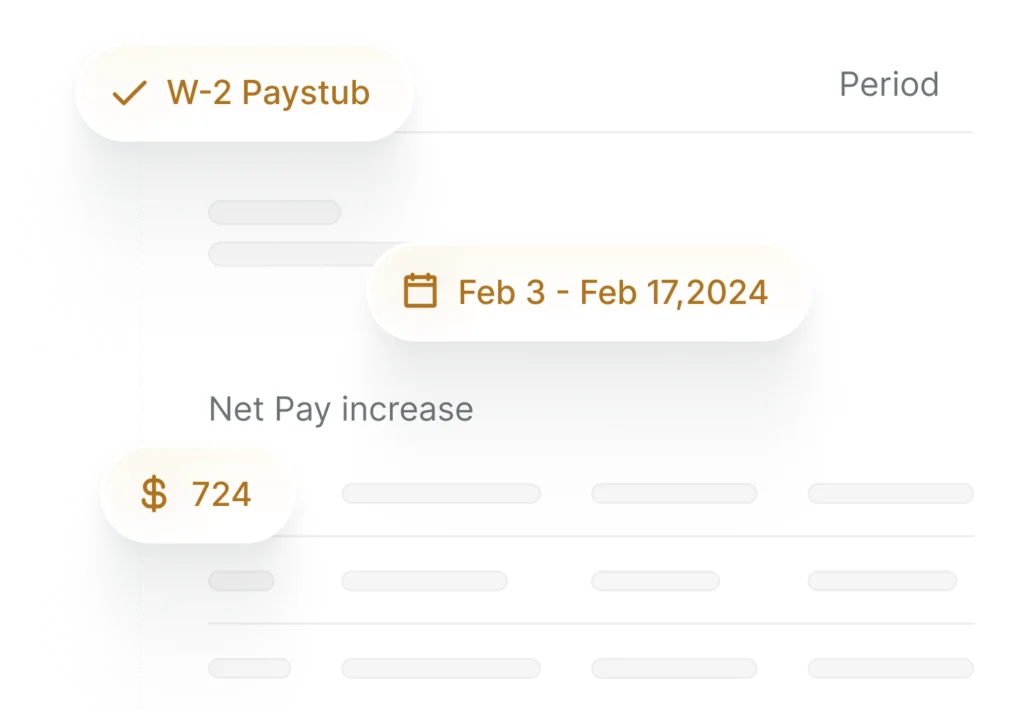

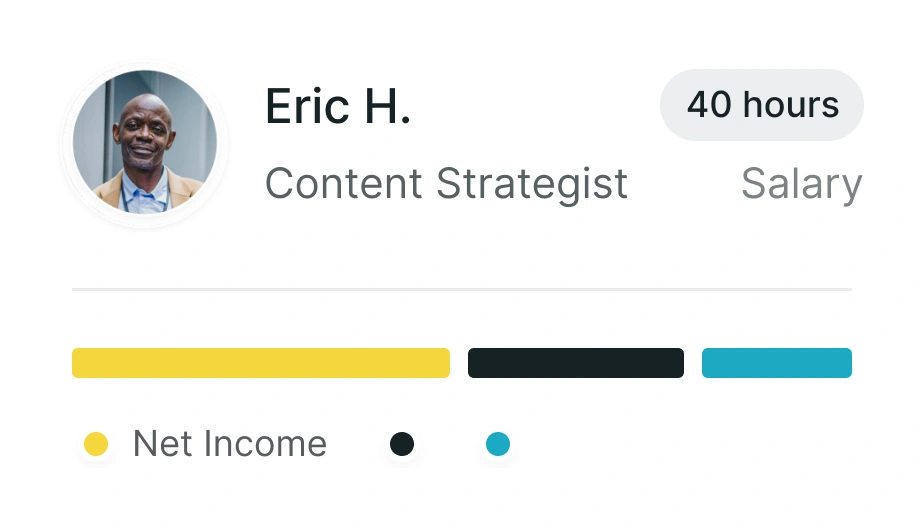

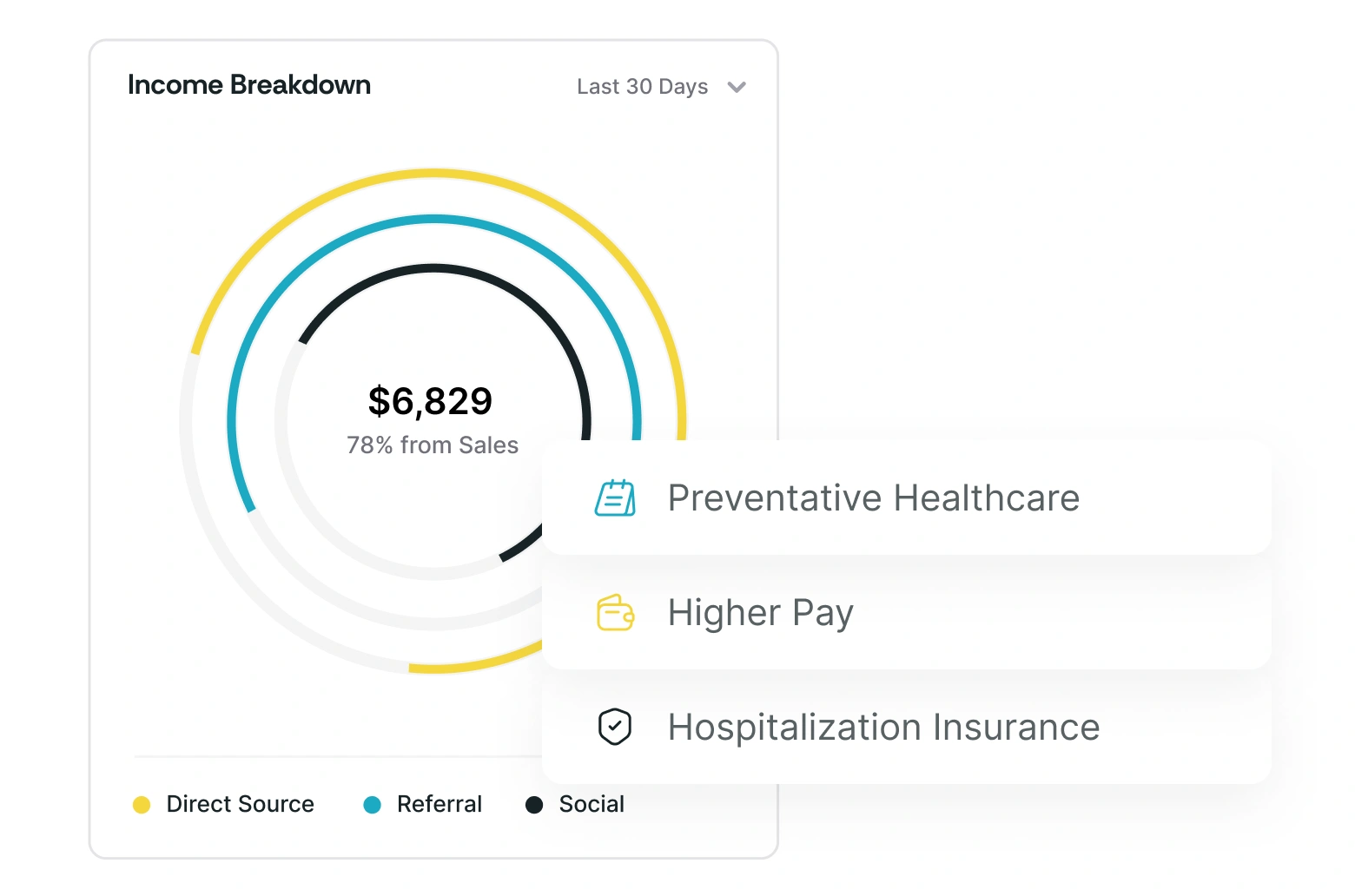

Total Paycheck Increase

$60.37/mo+2.6%

$724.48/yr+2.6%

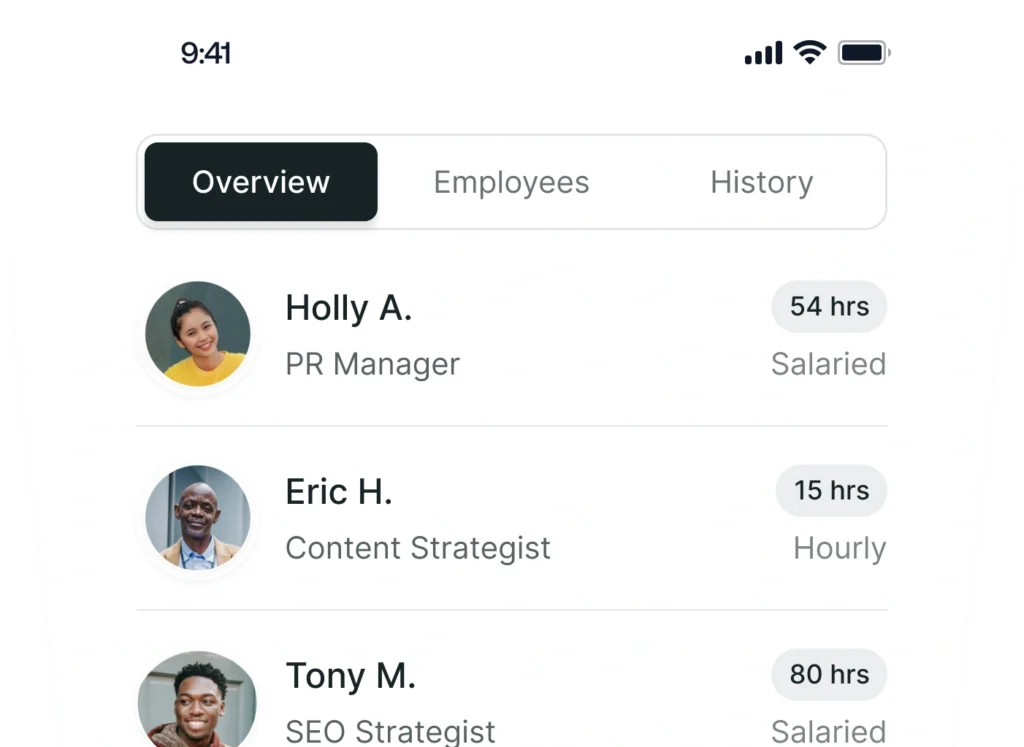

W-2 Employee Breakdown

Total Tax Savings

$260.37/mo

$3,124.44/yr

Total Policy Cost

$200/mo

$2,400/yr

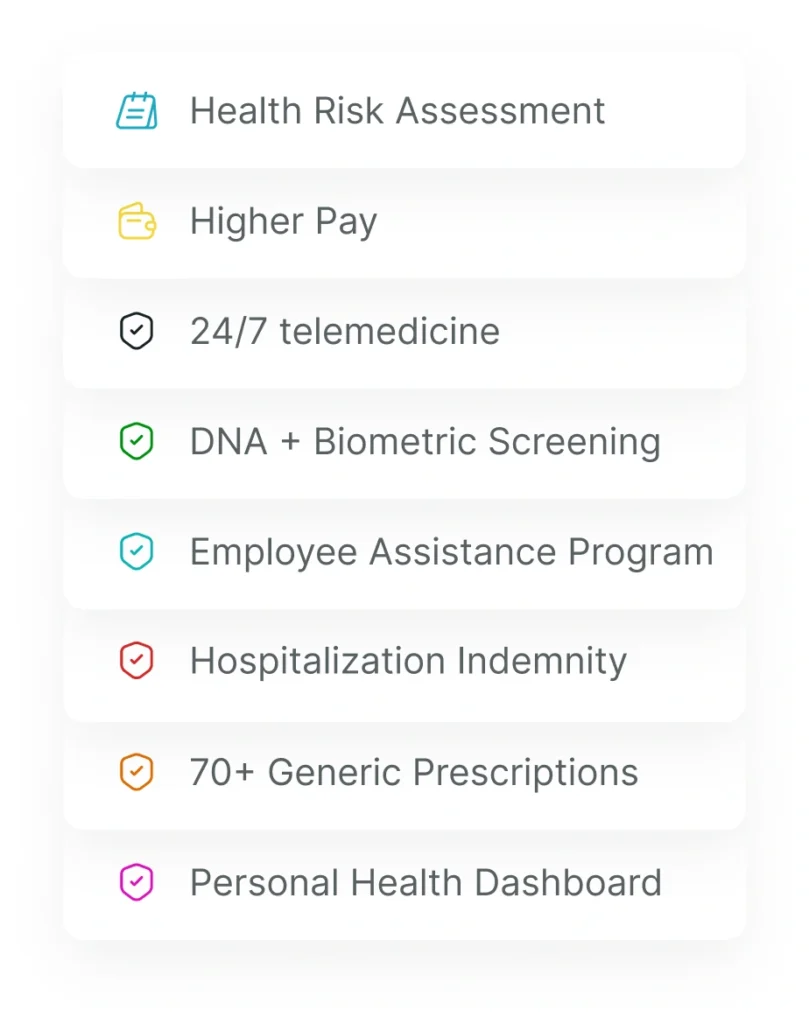

Total New Benefits

13+

Payroll Processed

©2025 Flex Health Benefits LLC. All Rights Reserved.